How we Defeated Debt to Travel the World

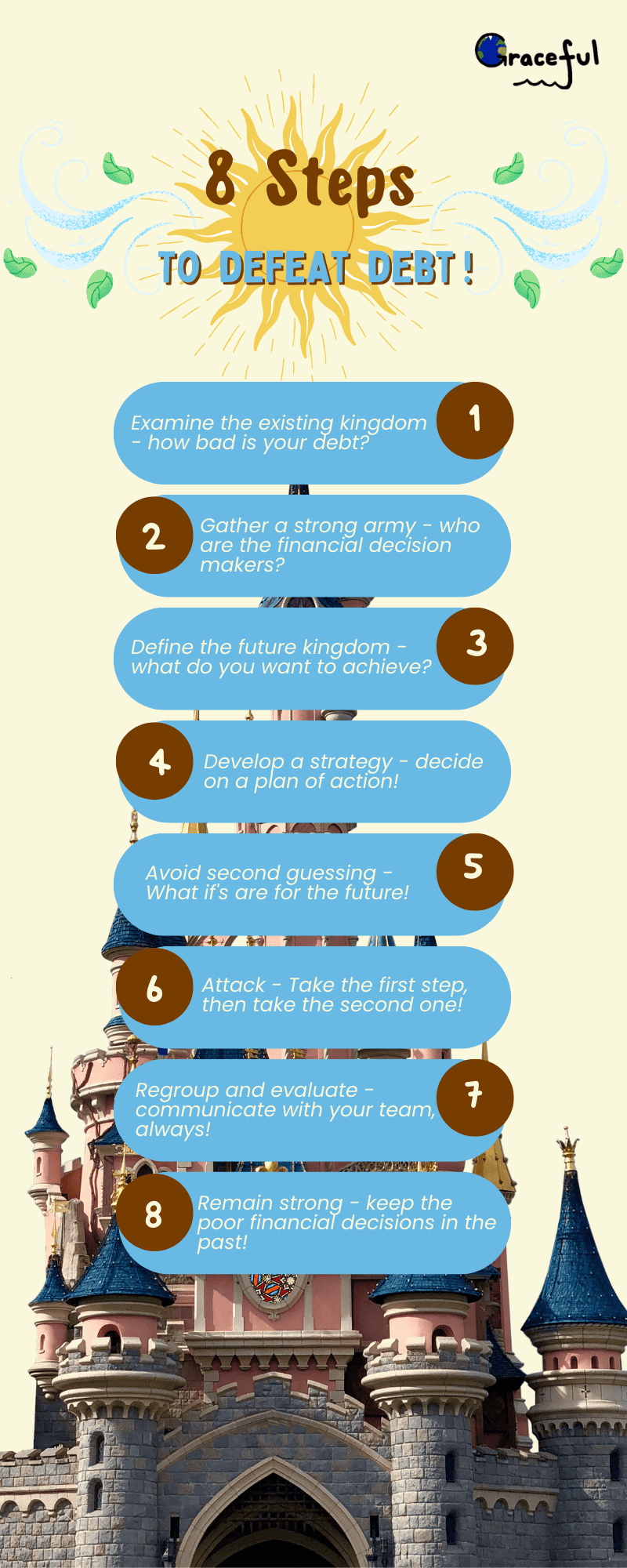

We will share our 8 steps to eliminate debt, absolutely free! It is doable and liberating!

We have been traveling the world for over four years, with three kids! To do that, we defeated all debt of over $350 000, so we do know a thing about saving, as well as a thing about spending. Let me share our steps with you.

It is not about the boat, or the RV, or the swim-the-English-channel goal. It mostly boils down to a couple of givens we try to keep our focus on – our place in space and our gift of time.

Disclaimer – This post is not intended to provide financial advice. The way we defeated debt worked for us, which is why I am sharing. If you feel that you must make a change in your life, use this post as an inspiration and seek professional financial advice. This post is for entertainment purposes only.

How bad was out debt? The numbers!

We started sailing full-time in 2018. At that point in our lives, we had the following debt and larger expenses:

- One suburbia townhouse with a 15-year mortgage – around $110 000 left to pay off.

- One large suburbia house with a 30-year mortgage – around $220 000 left to pay off.

- Two cars – paid off, but with their respective monthly expenses for gas, insurance and repairs.

- Tractor with a loan – around $5000 left to pay off.

- A home renovating project at $1000 per month (almost completed).

- Our first boat – $ 45 000 worth of home equity loan left to pay off.

- Student loan for my second career – $10 000.

- Expenses related to projects, health insurance premiums, other insurance, cell phone bills…

- Grocery bills from Wegmans and Costco…

- Flight tickets each year to visit my Bulgarian family – around $5000

As you can see, when we became a full-time traveling family, we were in quite a lot of debt already. It was a little scary, if I must be perfectly honest.

On top of that, I had to quit my brand-new career as a nurse, in order to set sail and homeschool the kids.

I should add that we both had excellent credit scores. Those provided a false sense of security! They only made us great targets for pitching more debt to!

Read on to find out just how we defeated debt and followed our dream to sail and travel full time!

Better yet, take a pen and paper, because there will be some useful tips to write down, absolutely free!

How we got in all this debt – true story!

Below is the story of our financial ups and downs. I am going to share it, because I believe it is important to explain how we accumulated our debt, and because this is my blog, and I can write whatever I want.

Seriously, though, telling stories is what I love the most, so here it is – quite entertaining too!

We started with $42!

Our combined finances right before we married, in March 2003, consisted of mostly loose cash and coins – $42!

Yes, forty-two dollars!

We wanted to build a life together, not build separate ones and then bundle them up.

Neither of us had a job, both were fresh out of college. We had run out of money sustaining our long-distance relationship with occasional transatlantic flights to visit each other.

So, we had a fairly clear drawing board to start with.

Where do we live – Bulgaria or America?

Due to my love for my beautiful country, Bulgaria, Joe agreed to try and start our lives there. However, in 2003 Bulgaria was a chaotic place in transition from communism to anarchy, with few rules, lots of crime and terrible bureaucracy to wrestle.

After a few months of trial, we decided that Bulgaria would not be able to provide a great future for two new graduates. I was sick and tired of the mess my country had become. Joe was not excited to be navigating it, with the language barrier on top of it.

We sold my first car – Lada Samara (go ahead, look it up, it is a pretty cool car), bought a German Shepherd puppy with the money and spent the little cash we had left to fly to the US and start our life there.

We decided to live in America – so new to me!

Apart from the white fence, which I was never quite fond of, we checked most boxes on the road to building a life in suburbia and chasing the American Dream. Whoever continues to promote this, should get a better mattress!

“Mortgage”, “credit card”, “check book” – all new words in my vocabulary.

They had not taught us those concepts in Bulgaria. I was so ignorant about how the US system worked, it was embarrassing! During communism, such Western notions were neither taught, nor approved of, to say it nicely.

First American embarrassments – checks and pizza!

At the end of Divine Liturgy, during my first months in the US, the priest casually included in his morning announcements, “Someone gave us a check with a donation, but there is no name, neither address, nor a signature, so it won’t do us much good!”

Ops… I thought the bank account number was enough.

Guess what I ordered on my pizza, in my very first American pizza order? Cheese!

“Ah, ma’m, they all come with cheese…”

To add to my misery of adjusting, my husband asked me to get him some “flipping capacitors” from Home Depot, for a project. I am not terribly shy, and I cared not to look up the flipping phrase in the dictionary. We are still telling the story in the family, as is that store associate, I am certain of it!

Building the American Dream – getting in debt.

The in-laws’ basement was our first home, for a year. In the meantime, we both found full-time jobs and decided to buy our first house…

“Mina, I don’t understand how you bought it, if you did not have the money to pay for it!“ My grandma kept wondering, when I announced we had purchased a beautiful townhome near Washington, DC, with great schools!

We borrowed money for the down-payment from our parents and jumped right into the land of unlimited possibilities, nourished by unlimited credit options! That brought us to bank loan number one!

Joe and I had jobs, making moderate amounts of money, sufficient enough to cover our mortgage. The house, however, was not the end of expenses – it was the beginning!

Digging ourselves deeper into debt (aka refinancing)

I was completely enslaved by TLC and HGTV, so remodeling seemed like the next logical step… Refinancing promised quick money, because we had equity in our home. Our credit scores were high, and we both worked – it was a no-brainer!

It was so fast and easy, no one even noticed! Guess what we did with the refinance money – we spent it!

Almost every other item, I can think of, comes with at least two possible, useful applications. Money is good for spending and that about exhausts its purpose. Not to mention its loosing value over time.

Solving the existential problem of space

A few years went by, and we were blessed with children – three of them!

Somehow, we decided that our two-bedroom, three-level home, was too small… We wanted to buy a single-family house with a yard.

Because we Needed more space!

Our townhouse was not worth very much (that housing market crash of 2007) and selling it was not a smart option. We decided to rent it and look for a larger home.

Off we went to the bank and asked them what we could afford, which is similar to going to the local gang, to ask them what kind of crime you should commit. The bank said we could definitely buy a bigger house, so we did.

That brought our house loans to two!

Showing off and more digging, for real!

Everyone who visited loved our huge house! it was unique, it was one-of-a-kind, it came with tons of history and stories (and renovation expenses, but we do not talk about that) … We showed it off with pride!

Which Psalm was it, where we read about naming our lands, as if they would follow us, one day?

What is another loan, when you are already spending money you do not have?! We purchased a new tractor, for the various projects around the house and to dig deep holes! That raised our loan number to three! I suppose I could throw in there the car loan… so, four.

Oh, and the constant house renovating project, also requiring a loan… so, five.

Wait, and I decided I wanted to be a nurse, instead of a philologist, so, six.

Then, in June 2017, we purchased a sailboat, with a line of credit. That marked the end our loans story.

Thank goodness!!

How we eliminated all debt to travel – the Steps!

Eliminating all debt was crucial in our financial plan, because we wanted to be free to sail away, and planned to be unemployed while traveling by boat.

Deciding to achieve financial independence and not be tied to loans and lines of credit may feel like going to war. It is a war against bad habits, continuing mistakes as well as the entire system.

Every financial institution in the US wants you to be in debt!

So, prepare!

When Joe and I married, we were crowned King and Queen of our new kingdom (we married according to the Eastern Orthodox Tradition).

Earthly financial matters are, therefore, royal matters, even if the ultimate purpose is a different kind of Kingdom. So here is how we prepared our kingdom for war!

Step 1 – Examine the existing kingdom!

It would be unwise to go to war, if we didn’t even have an idea what we were defending and what we had to eliminate, or trade, in order to achieve financial peace at the end of the war!

We had two houses, a tractor and a boat with their respective loans. We also had two cars, which we owned fully.

Our palace was filled with many home treasures, accumulated over the years – boxes of holiday decorations, rarely used gadgets and utensils, never-used wedding gifts, antique pieces of furniture in parts, broken-to-be-fixed-one-day cool things, etc.

The most precious of our possessions were diligently wrapped and hidden in the darkest of attic corners, for the next generations. (Below this post, find a link to our post about decluttering and downsizing).

What about you? What do you have? Do you know every loan and credit card balance you may have? Write down all of your significant possessions, their values and how much they are costing you. Below is an example (these are made-up, to demonstrate).

| We have: | Value – what can we sell it for? | How much do we owe on it? | Expenses: |

| Car 1 | $3000 | $0 | $200/month |

| House | $300 000 | $250 000 | $1600/month |

| TV | $300 | $0 | $0 |

Step 2 – Gather a strong army!

It goes without saying that if the kingdom is not united, the war is lost before it started. In our case, we were an army of 5. We did not feel the need to hire any additional soldiers and financial advisors. They could be useful in other more complex court matters. We wanted to keep things simple.

After a year of sailing, we all decided it was time to eliminate debt. Our children were old enough to understand that the life we were leading was not sustainable. We all had discovered the far more rewarding life of experiences, versus that of acquiring things.

Once the royal family decided to continue to travel, the king and queen had to make some grand financial decisions.

Your army might be different. Perhaps your children are still young and there is no point in discussing major financial decisions together. You might have a child in college with the college expenses tagging along. Maybe there is an elderly grandparent, who needs your help.

Decide who you are financially responsible for and start from there. Keep in mind, if you wait too long, spending and responsibilities will only increase.

Step 3 – Define the future Kingdom!

Did we need the houses, tractor, cars, possessions? They had become burdens! Did we need to be in that particular part of the country – we did not! A castle close to the capital would be inevitably more expensive, than any other one.

All we needed for our future kingdom was a boat, time to travel the world and some sort of reliable small income.

Your future kingdom may include an RV, a storage unit, at least one car. Perhaps you are not traveling for long and would like to have the means to buy another house in a year, or two. Traveling might not be part of your dream at all.

Regardless of how similar, or different your future may seem, take the time to sit down and define what you wish your future financial situation to look like. What is your ultimate goal – to travel, to pay off a large loan, to move to a different area, to live on a boat (drop us an e-mail about that one, we can chat!).

Step 4 – Develop a strategy (how we defeated debt)

Our ultimate goal was to be able to sail and travel, and be as financially independent as possible.

We decided to keep our smaller townhouse. It was in a great location, with easy maintenance and reliable rental options. That would be our consistent income, while traveling. It was also an asset, in case of an emergency, unexpected expenses, or simply a land base.

Our larger house had appreciated in value and even though it was so amazing, it had to go! That would allow us to clear all debt in one strike and have a small amount of savings for emergencies.

What is your strategy? Write down various scenarios to reach your goal/s. Then look at the scenarios and pick one!

Step 5 – Avoid second guessing!

“If we leave this perfect neighborhood, we would never afford to come back!”

“What if we hate the boat in another year and have no place to return to?!”

“What if we never manage to get what we want for our house?”

“That tractor, we love it, maybe we can keep it in storage?”

The list of “what if’s” and “just in case” could easily be continued. We did have those conversations, repeated the conversations, and sometimes even had the conversations at night, which is a major mistake!

On top of your own worries, the more advisors you summon, the more they will add to your list. Every royal advisor wishes to be important, so expect a push back and critiques from relatives and friends!

We decided to only have plan A, pray, and cross any other bridges, when and if we arrived there.

Step 6 – Attack!

With a strategy in place, we wasted no additional time in extra research and doubting.

First, we sold a lot of cool and useful items, and took quite a few trips to the donation center. That cleared up our huge house significantly!

We sold the tractor!

I found a job as an RN in a hospital – student debt cleared in fewer than three months!

We sold both of our cars.

We sold the beautiful, old, spacious house in the perfect location.

We paid off our small townhouse, as well as our first boat. All debt cleared!

With lots of research, phone calls, and some luck, we found a larger boat, which we purchased with cash and fixed.

In 2021 Joe resigned from his career of 15 years, right at the worst possible time (it is always the wrong time to go against the flow, by the way).

Step 7 – Regroup and evaluate!

In our society, you will be penalized for paying with money you DO have!

With all of our debt defeated, it felt so strange and so liberating to not have to worry about loans or mortgages!

Navigating the system in terms of setting up our own payment of taxes, insurance, mail services, healthcare and so on, is an ongoing obstacle course. Everything in our society is catered to keeping people in debt.

Once you detach yourself from the established order, you end up speaking a lot to supervisors, because the standard algorithms won’t work!

Step back and take a look at the results, be grateful and move on. Pat on the shoulder is useless and totally un-royal.

Step 8 – Remain strong!

Once debt has been cleared, it is easy to decide that you can do it all over again. So, what’s another large purchase, because you want it right now!

Resist and remain strong! Unless there is an emergent need to change course, keep that spot you worked so hard to reach!

Borrowing money for a bigger and nicer boat was, ah, so tempting! Just a phone call to the bank and a turn-key boat could be ours in no time! No more projects, no more fixer-uppers… it was not easy to resist that route, not at all.

In addition – no more restaurants, including fast food. I could make three dinners for a family of five, for the price of one outing! Not eating out has not been difficult at all, actually. We all are perfectly capable of chopping vegetables and mixing things together!

Check out our post on our monthly spending, via the link below this post. It required some adjusting, but it is totally doable.

The new kingdom!

We absolutely love our new kingdom! We cherish countless amazing memories of our family discovering different places, together. We touch as many stars as we wish.

The whole world is our kingdom now. And, guess what – it is yours too! You and we have a kingdom to share!

Our final royal piece of advice – we try not to rule that kingdom, otherwise we will surely ruin it!

Free Infographic

Check out our other posts related to money and traveling:

Below are some other posts you may find useful and entertaining, regarding traveling and spending/making money.

How to Ditch Suburbia and Sail Away (11 Steps to Follow a Dream)!

The Cost of Cruising Life for our Family of Five?

5 Comments