12 Practical Ideas to Save More in 2024

Patience, discipline and some perfectly bearable sacrifices are all that is needed to avoid and reduce unnecessary debt and expenses. Here are 12 practical ideas to spend less.

Our family has followed these simple rules for over twenty years. This is how we were able to clear our debt of over $350,000, live on two sailboats, start a business and fully own all of our homes.

Oh, and fly around the world, visiting amazing places.

We also accumulated quite some debt, which we were able to fully eliminate. Here is how:

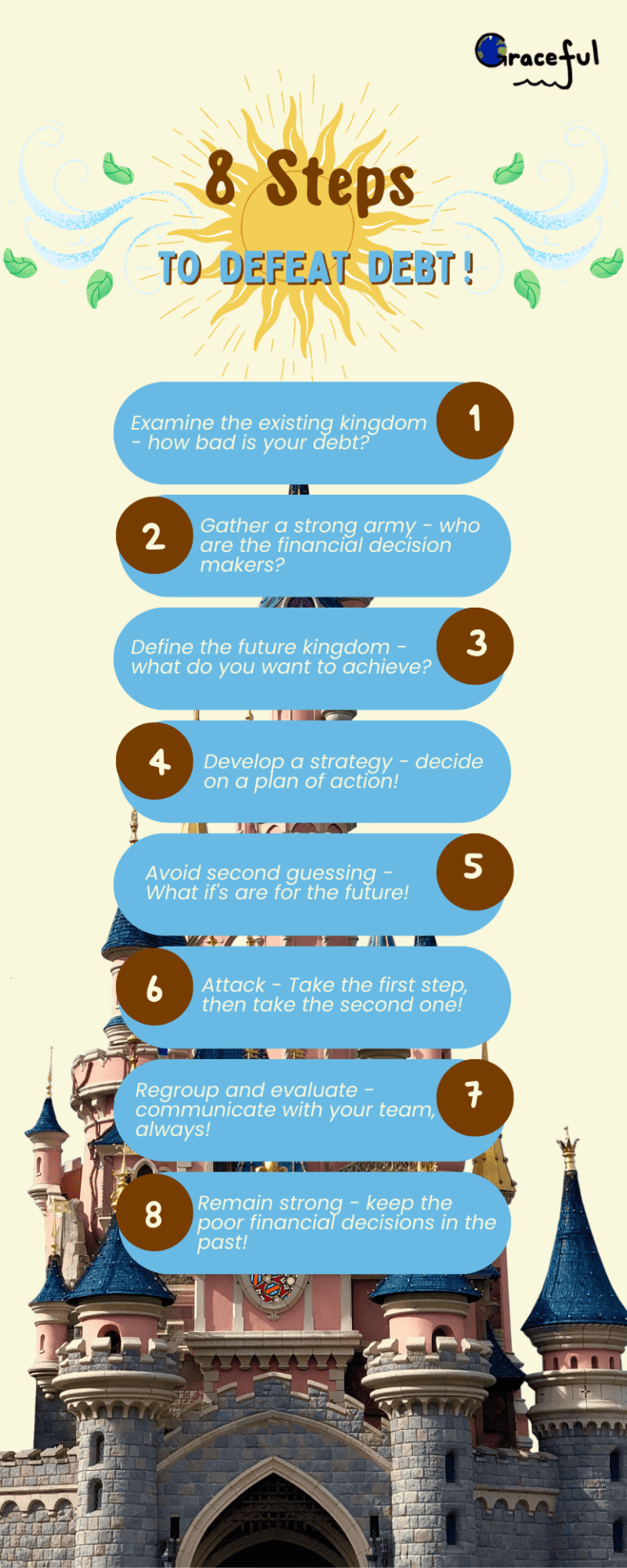

How we Defeated Debt to Travel the World (Still Traveling in 2023)

Below is our “big secret” to plan and control spending. Borrow as many ideas as you wish.

* Please note, this post does not provide financial advice. We are not financial planners. The information in this post is not a substitute for financial advice by professionals.

12 Practical Ideas to Spend Less.

Some of these might be quite simple, we try not to overthink things. Overthinking can lead to over-worrying and, inevitably, overspending.

1. Agree to agree

The best way to reduce unnecessary spending, is to agree on following your rules together! Otherwise, tensions and arguments may damage your relationship.

Our finances increased significantly once we became a family and decided we had to have all those “must-haves”. So, we were in agreement to start spending. Not a great decision, but we made it together.

In fact, small steps towards working together help achieve much larger dreams and plans:

11 Steps to Follow Your Dream and Travel!

While we were single, we only had one person to care for, soon after we married – there were five of us!

If you prefer to be guided by a professional, there are many financial advisors, but do bring your own list of priorities along.

2. Learn to Wait

With two college degrees, from two prestigious universities, we found jobs fairly quickly – I worked at Starbucks, and Joe worked as a waiter.

Finding good jobs was harder than we had anticipated.

Our first home was my in-law’s basement, which we shared with our German shepherd, for one year. We wanted to be on our own, but we had no money.

Have patience, the common “here and now” mentality can only harm you. Spend less today, there are always opportunities to spend more tomorrow.

Read a bit about the market. If prices have been going up and seem unreasonably high, then they are just that. Maybe living in your parents’ basement is not the best option for you – then rent a place for a year, or two.

3. Borrow only what a single income can pay back

When we shopped for our houses, we ignored our bank’s words of wisdom.

The bank does not have your best interest in mind. Banks exist to make money. The more you borrow, the more money they make.

I was unpleasantly surprised at how pushy the banks were, trying to tell us we could easily afford more than we wanted to spend.

It is not easy – a $500 000 house looks a lot better than a $300 000 house. It even changes the neighborhood. But what if you had to live on one income only (which we did for many years), and had bought into a two-income mortgage?

Besides, cleaning and decluttering a large house is a nightmare. Here is an article about removing all kinds of “valuables”, which clutter the attic:

How to Remove Suburbia Stuff and Travel

4. Sharing is caring. Do it.

Here is a lesson we are all thought as early as we are able to grab a toy from another kid’s hands. We teach our kids the same lesson, and we abandon everything learned at the first opportunity to do so.

Share a car.

I almost blew my first real-job interview, when I shared we were sharing a car! For the first six years of our married life, we shared one car.

I did manage to convince my future boss that it was not going to be an issue.

Sharing a car, while driving not to one, but to two places of employment, in DC suburbia was madness. But a doable madness.

Taxi drivers drove all the time, so could I.

There are quite a few commuter parking lots, and car sharing apps these days, to make car-downsizing much easier.

Share your bedroom.

When our first child was born, I was beginning to feel nauseated by the shopping hysteria surrounding a new baby. My grandma kept her babies out in the fields with her. Why wouldn’t I share a room with mine?

We did, and saved thousands!

When I was growing up, my parents slept on a pull-out sofa, in the living room, for ten years. My sister and I shared the only bedroom in our small apartment.

Try it, you might like it. It will definitely help with downsizing to live on a boat one day 😉

Make your kids share.

Buying a three-bedroom house is a lot more expensive than buying a two-bedroom house. We spent ten wonderful years in our two-bedroom townhouse, and the last three of them, we were a family of five.

It was awesome – late night giggles from the room next-door. No one scared of anything, because no one was ever alone. Our three kids shared the same bedroom – a never-ending sleepover.

Wondering how much living on a boat might cost? We have tons of answers and tips in our post:

The cost of living on a boat for a family. With a Free PDF table!

Share your house.

We have never done that for payment, but we have plenty of friends, who rent out a room, or a basement and bring in additional income.

Some boat friends of ours rent out their house short term, while traveling, or sailing. Not everyone lives on a boat full time.

5. Keep it simple.

For us that meant only having one joint bank account, one credit card and filing taxes jointly.

Always.

That’s it! No contracts, no elaborate financial machinery, no complicated division of assets.

What helped us, was that we started from the bottom. We managed to build something together from the ground up. We can always repeat the steps, if necessary.

6. Avoid credit card debt.

The easiest and least confusing decision, for us, was to only have one credit card. Everything went on that credit card, even gum. It earned us miles, and, at the end of the month, we had only one bill to pay.

Always pay your credit card in full, each month! If you have accumulated credit card debt, pay it down first, because it is likely to be the debt with the highest interest.

We have used credit cards for home renovation projects, with zero interest for one year. As long as you are certain you can make those payments every month, they won’t harm your budget, nor your credit score.

7. Don’t answer all “What if’s”.

What if someone fell sick? What if someone needed long-term care? What if we both became unemployed? What if it all fell to only one of us?

With supportive family and relatives, we knew we would have a place to stay. Having started with $42, we were not terribly afraid to start from scratch again.

When the kids arrived, our “what if” questions were a bit more complicated and a bit scarier, so sticking to our financial habits became that much more important.

We have not answered all of our “what if” questions, because they can spiral down an endless hole of pessimism and despondency. Not worth it.

It is not about having some grand master plan in action, but rather being aware of our vulnerability and mortality.

8. Stop using shopping as therapy.

To be honest, we have never had an actual budget – too much work! It is a lot easier to stop shopping.

It does work in our interest that I absolutely hate shopping. I don’t find it relaxing at all. When I buy something, I cannot wait to go back and return it!

Do you need a large-screen TV? Do you need yet another pair of shoes? Do you need that $5 Late? It adds up very quickly! Ah, but you deserve them – that’s nonsense.

Yard sales have everything you may ever need, and if you go around noon, most people are so tired of sitting outside, you will get stuff for free.

After all, one person’s trash is another one’s trash!

9. When you must shop – bring a shopping list!

Of course, you have grocery, clothing and other expenses. Shop in cheaper grocery stores and bring a list.

And read the list!

Having a shopping list for anything, not just groceries, will help keep you focused and avoid grabbing that next great deal.

There is much, which we mislabel as “needs”. Here is our inspiring post on removing unnecessary things to breathe a bit easier,

How to Remove Suburbia Stuff and Travel

Wondering how the heck you can resist – write down a message for yourself, “Do not buy anything that is not on the list, Mina.” Then highlight it.

10. Keep an emergency fund

It is one of the most frequently seen pieces of advice out there, so I am including it.

The most common amount I have seen, is a six-month’s worth of paychecks. That would be ideal to allow you time to find a different job, downsize, or whatever else may be needed.

When you follow the other simple commonsense rules, you end up spending less, and the “fund” builds itself – be it in real estate value, savings, or other assets.

11. Turn debt into an investment.

Debt can and should be managed! In our case, most of our debt was an investment. We are not trained investors, we just follow one simple idea, which we heard on TV, so it must be true (The Lego Movie).

All we know about investment is that you should try to buy low and sell high.

Our possessions, carrying the highest debts, were assets. We bought them when the market was low/normal, and we sold when the market was high.

Some of our possessions never appreciated in value. For example, our cars, but they were needed in order to take us to our places of employment, where we made money. They often took us to tons of places where we spent money, so I am not sure I am making a great point here, but it’s a cool idea.

Some of our investments were total money pits (our first boat), and we ended up losing money on that one, but we did not care. The experience was worth it. We gained more than we put into it. So, in that respect, it was a great investment!

Because we said so!

Which brings me to the next point:

12. Accept responsibility.

You are the sole person responsible for spending more than you are making.

When my dad came over to help with the kids, while I was in nursing school, he told me something so true. I kind of dismissed it back then, because we had no intention of leaving our suburbia environment.

“Mina, living in the US feels like being locked in a golden cage.”

Think about it – if you wish to live in a good neighborhood, you must buy a house you cannot afford. You must buy at least one car. You must spend money to take care of the house.

You cannot quit your job. You cannot travel much. You must plan for expensive college tuition too. You must adjust your thinking to match the golden cage lifestyle.

In order to avoid unnecessary spending, you must realize that you are in charge of all of your financial decisions. Own them – the smart ones and the stupid ones. Especially the stupid ones!

We have been and continue to make financial mistakes. We do not calculate the pros and cons of every decision we make. Sometimes (most of the time in our case), we make a decision, because it feels right, for us, at that point in time, in that particular universe.

Then, we pray and keep going. Or we stay upset for some time and keep going.

Your Turn – Answer This One Thing:

You might be surprised to find out you are already following some of these rules. It is just a matter of following them consistently.

Think of one smart thing you did with your time, money, or other valuable resources last week. Just one thing.

Write it down.

Write three reasons why you made that choice. Here is a personal example:

Last week I did not buy those boots, because:

- I wanted to wait until they went on sale.

- Our credit card clears tomorrow.

- The heels were a bit too high.

In just this simple decision, I already followed two of the rules listed above – waiting and making sure the credit card can be paid in full.

Your turn – feel free to list the one smart thing you did last week, in the comments below! And, if you enjoy the post, please, share it.

Thank you.

12 Practical Ideas to Spend Less. Conclusion in a Table.

| Commonsense Rules | Main takeaway |

| 1. Agree to agree | Or tensions and arguments may damage your relationship. |

| 2. Learn to wait | Spend less now, there are always ways to spend more tomorrow. |

| 3. Borrow based on a single income | The bank does not have your best interest in mind. |

| 4. Sharing is caring | We did, and saved thousands! |

| 5. Keep it simple | One credit card, one bank, one TV, one pair of jeans |

| 6. Avoid credit card debt | Always pay your credit card in full, each month! |

| 7. Don’t answer all “What if’s” | The fastest way to panic, is to ponder them. |

| 8. Shopping is not a therapy | Ah, but you deserve it – that’s nonsense. |

| 9. Bring a shopping list. | Read the shopping list. |

| 10. Keep an emergency fund | Six months’ worth of paychecks. |

| 11. Turn debt into an investment | We saw it on TV, “so it must be true” – buy low and sell high. |

| 12. Accept responsibility. | Own your smart and stupid choices, especially the stupid ones. |

Found this Post Helpful? Pin it for Later.

FAQ About Spending and Saving

Is it best to avoid debt altogether?

No.

I don’t think you should be afraid of debt. Debt is not a monster, which creeps up on you. Debt is a tool and is created by you, in order to fulfill a purpose.

Ask yourself, “What purpose is this debt serving?”

If it is a step towards something potentially more rewarding, then ask yourself, “Are there alternatives, acceptable to you?”

If there are – explore them. If there are not, use the tool wisely.

What is the number 1 cause of debt?

According to Bankrate, and this came as no surprise at all, it is home mortgage balances.

We have created a habit of unaffordable purchases, which we continue to make.

While living in the US, we had not one, but two mortgages. Was it scary? Yes, at times it was.

Are most families in debt?

Yes, they are! More than 75% of households in America are in debt (Ramsey Solutions)- mortgage, personal loans, school loans, credit card debt, and so on.

We were part of that statistics, and we are not afraid to be part of it again, if we decided to do so.

How much debt is too much for a family?

If you are not able to pay your credit card and your mortgage in full (I am not talking about minimum payments here) every single month, then you are spending more than you can afford.

Start reducing the debt – pay off the debt with the highest interest first!

How much debt is normal?

Debt is normal, if it is controllable and manageable. Unnecessary spending is never normal.

At this point in time, we have no debt. Considering our current income and future business plans, not having debt is the normal thing for us, right now.

It is not a final; it may not last. But we have a say about it.

Is it better to pay off debt, or to save?

Ideally, do both – one step at a time.

Or, go in bigger strides, if that feels right.

If you are a family, it must feel right for both of you – going back to where we started:

Agree to agree.

Wonderful advice!

Thank you very much for following us.

I always like reading your posts but this one in particular has some really good advice. Thanks for sharing and being so open about the financial part! Also-I can’t find a link anywhere for your beer making business. Do you have a website up yet that I could check out? Would love to see how your operation is going now that you are back on land. Thank you for the wisdom!

Marian, thank you very much for following us!

The beer making business is still in the walking to various desks and getting stamps and not getting stamps, and asking for stamps, and wondering why no one is giving us stamps… it’s all about paperwork in Bulgaria, we have way too much!

So, there is essentially not much to write about. I will probably upload an episode on some aspects of it, but I don’t have enough material for an entire blog.

Maybe I will start a blog and just share everything we learn there, about making beer and opening a brewery, I will definitely announce such future endeavor.

We did make a couple of batches at home and they were delicious, so it’s really not rocket science.